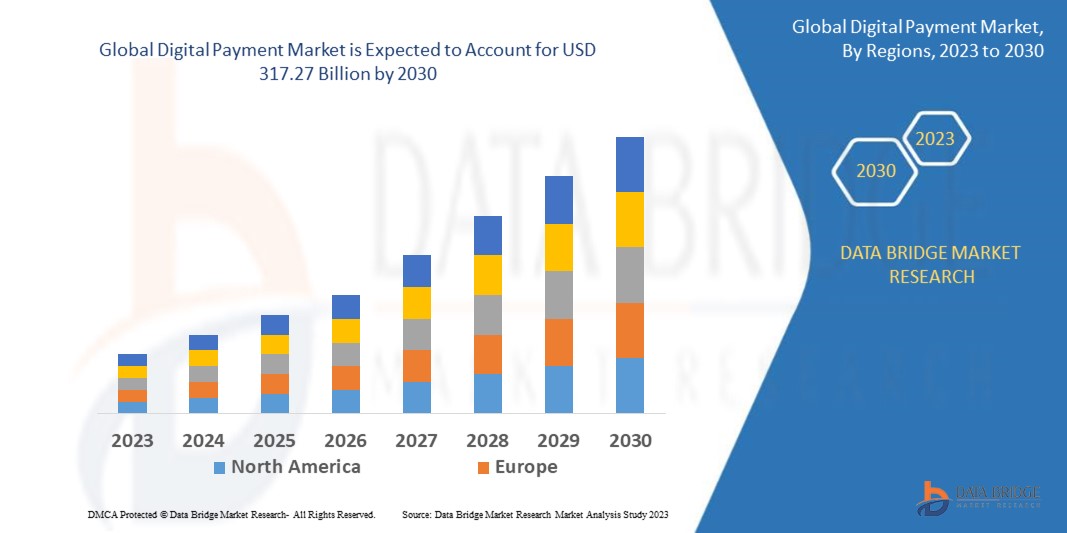

Data Bridge Market Research analyses that the digital payment market, which was USD 94.34 billion in 2022, is expected to reach USD 317.27 billion by 2030, at a CAGR of 20.60% during the forecast period 2023 to 2030.

Introduction

The digital payment market is transforming the way individuals and businesses conduct financial transactions across the globe. With rapid advancements in technology, increasing internet and smartphone penetration, and changing consumer behaviors, digital payment solutions have become an integral part of the modern economy. Europe’s digital payment landscape is characterized by a diverse ecosystem that includes mobile wallets, contactless cards, online banking, peer-to-peer payment platforms, and blockchain-based solutions.

Governments and financial institutions are actively promoting cashless transactions, aiming to enhance security, reduce operational costs, and foster financial inclusion. This article explores the key trends, drivers, challenges, regional insights, and future outlook of the digital payment market, providing valuable information for payment service providers, fintech companies, investors, regulators, and industry experts.

Market Overview

The digital payment market in Europe is witnessing robust growth due to the rising demand for convenient, fast, and secure payment methods. Consumers are increasingly shifting away from traditional cash payments, opting instead for digital alternatives that offer ease of use and enhanced functionality. The sector is supported by innovations in financial technology, regulatory reforms such as the Revised Payment Services Directive (PSD2), and growing cross-border e-commerce.

Digital payments encompass various channels and platforms, including mobile banking apps, payment gateways, QR codes, and wearable devices. Europe’s regulatory environment, combined with its advanced technological infrastructure, provides a conducive environment for payment innovations, while cybersecurity and data protection remain key considerations.

Key Drivers of Market Growth

Technological Advancements

Advances in smartphone technologies, biometric authentication, and near-field communication (NFC) have made digital payments more accessible and user-friendly. Innovations in artificial intelligence (AI) and machine learning are enhancing fraud detection and transaction monitoring, providing consumers and businesses with secure platforms.

Government Regulations and Financial Inclusion

Regulatory initiatives like PSD2 and General Data Protection Regulation (GDPR) have promoted competition, improved transparency, and fostered customer protection in the payment ecosystem. Governments are also encouraging digital payment adoption as part of broader financial inclusion strategies aimed at reaching underserved populations.

Changing Consumer Behavior

Consumers are increasingly embracing digital platforms due to the convenience, speed, and flexibility they offer. The rise of e-commerce, subscription-based services, and remote work has accelerated the adoption of cashless payments, especially among younger demographics.

Growing E-Commerce and Cross-Border Transactions

The surge in online shopping and cross-border commerce has driven demand for secure, seamless payment solutions. Digital payments facilitate transactions across regions, currencies, and platforms, supporting the growth of global trade and digital marketplaces.

Applications of Digital Payments

Retail and E-Commerce

Retailers and online merchants are leveraging digital payments to enhance customer experience, streamline checkout processes, and enable subscription-based models. Contactless payments and mobile wallets have become standard features in brick-and-mortar and online stores alike.

Banking and Financial Services

Banks are investing in digital solutions to offer mobile banking, peer-to-peer transfers, and instant payments. These services are helping reduce operational costs while improving service delivery and customer engagement.

Travel and Hospitality

Digital payments are widely used in travel booking platforms, hotels, and hospitality services to facilitate fast and secure transactions. Contactless payments have become essential in ensuring hygiene and reducing physical interactions.

Healthcare and Education

Digital payment solutions are being adopted in healthcare facilities and educational institutions to simplify billing processes, insurance payments, and tuition fee management. Automated invoicing and secure payment portals are enhancing operational efficiency.

Corporate and Government Payments

Enterprises and government bodies are increasingly integrating digital payments into payroll systems, tax collection platforms, and public welfare schemes to improve efficiency, reduce fraud, and streamline fund disbursement.

Regional Insights

Germany

Germany’s advanced banking infrastructure and high consumer trust in digital platforms have contributed to rapid adoption. Fintech collaborations with traditional banks are driving innovations in mobile payments and digital wallets.

United Kingdom

The UK is a leader in open banking initiatives, leveraging PSD2 regulations to create secure and interoperable payment platforms. Fintech startups and established players are offering personalized services tailored to customer needs.

France

France’s e-commerce growth and government-backed initiatives to promote digital payments have increased adoption rates. Regulatory reforms aimed at enhancing consumer protection and fostering competition are supporting market expansion.

Nordic Countries

The Nordic region, including Sweden and Finland, is at the forefront of cashless economies, with high smartphone penetration and widespread use of contactless payment methods. Governments and banks are actively encouraging digital payment infrastructures.

Eastern Europe

Eastern European countries are gradually embracing digital payment solutions as internet access improves and fintech ecosystems expand. Governments are supporting initiatives to bridge the digital divide and enhance cross-border payment interoperability.

Challenges in the Market

Data Security and Privacy Concerns

As digital payments grow, cybersecurity threats such as data breaches, phishing attacks, and identity theft pose significant risks. Maintaining robust encryption standards and compliance with privacy regulations is critical to ensuring trust.

Infrastructure Gaps

Despite increasing smartphone penetration, certain regions face infrastructure gaps such as inconsistent internet connectivity and limited access to digital banking platforms. Investments in telecommunications and financial infrastructure are needed to expand coverage.

Regulatory Complexities

Diverse regulatory frameworks across European countries can create challenges for cross-border payments and international fintech collaborations. Harmonizing regulations and ensuring interoperability remain ongoing concerns.

Digital Literacy and Trust Issues

Segments of the population, especially the elderly and rural communities, may lack familiarity with digital payment tools or harbor concerns about fraud. Educational campaigns and simplified user interfaces are essential to boost adoption.

Future Trends

Biometric Authentication and AI-driven Fraud Prevention

Future digital payment solutions will increasingly incorporate biometric verification such as facial recognition and fingerprint scanning, along with AI algorithms that detect and prevent fraudulent transactions in real time.

Integration with Emerging Technologies

Blockchain, distributed ledger technologies, and programmable money are set to enhance the transparency, efficiency, and traceability of payment processes. These innovations could redefine how transactions are processed and secured.

Expansion of Cross-Border Payment Solutions

The rise of global e-commerce and international partnerships will drive the development of interoperable payment platforms that offer seamless multi-currency transactions, automated compliance checks, and reduced transaction fees.

Focus on Sustainability

Digital payment providers are exploring ways to reduce their environmental footprint through green fintech initiatives, such as paperless billing, energy-efficient data centers, and investments in sustainable infrastructure.

Conclusion

The Europe digital payment market is poised for significant growth as technological innovations, regulatory reforms, and changing consumer behaviors reshape the financial landscape. While challenges related to data security, infrastructure gaps, and regulatory complexities remain, ongoing investments and collaborative efforts are helping to address these barriers.

As governments, businesses, and consumers increasingly prioritize convenience, security, and financial inclusion, digital payments are becoming an essential component of Europe’s economic development. With advancements in AI, biometrics, and blockchain technology, the future of digital payments is set to be more efficient, transparent, and accessible than ever before.

Frequently Asked Questions (FAQ)

What are the key factors driving the growth of digital payments in Europe?

How are technological innovations improving the security of digital transactions?

What challenges are limiting the adoption of digital payments across regions?

How are government policies and regulations supporting market expansion?

What future trends are expected to shape the evolution of the digital payment ecosystem?

Equip yourself with actionable insights and trends from our complete Digital Payment Market analysis. Download now:https://www.databridgemarketresearch.com/reports/global-digital-payment-market

Browse More Reports:

Global Siding Market

Global Sleep Masks Market

Global Sleeve Labels Market

Global Small Kitchen Appliances Market

Global Smart Lighting Market

Global Smartphones Market

Global Smart Water Management Market

Global Snack and Nut Coatings Market

Global Solar Panel Cleaning Market

Global Spirulina Powder Market

Global Sports Protective Equipment Market

Global Subdermal Contraceptive Implants Market

Global Sugar Decorations and Inclusions Market

Global Sustainable Plastic Market

Global Tandem Piston Compressor Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 987

Email:- corporatesales@databridgemarketresearch.com