In the ever-evolving panorama of funding options, Gold Individual Retirement Accounts (IRAs) have emerged as a well-liked selection for individuals searching for to diversify their retirement portfolios. Gold IRA companies play a crucial function in facilitating the acquisition and administration of valuable metals inside retirement accounts, providing traders a hedge in opposition to inflation and financial uncertainty. This text explores the functions, advantages, and considerations related to Gold IRA companies, as properly because the broader implications for retirement planning.

Understanding Gold IRAs

A Gold IRA is a specialised sort of Individual Retirement Account that allows traders to carry physical gold and other treasured metals as a part of their retirement savings. Unlike conventional IRAs, which usually put money into stocks, bonds, and mutual funds, Gold IRAs present a possibility to include tangible belongings which have traditionally retained worth over time. The underlying principle is that gold, as a finite resource, can serve as a safeguard against market volatility and forex devaluation.

The Function of Gold IRA Companies

Gold IRA companies are financial institutions or custodians that specialize in the management of Gold IRAs. Their main features include:

- Establishing the Account: Gold IRA companies help purchasers in establishing a self-directed IRA, which permits them to invest in different belongings, including gold. This course of includes paperwork, compliance with IRS laws, and selecting a custodian to handle the account.

- Facilitating Purchases: Once the account is established, Gold IRA companies enable traders to purchase permitted valuable metals. When you beloved this post and you would want to get more information relating to affordable companies for ira rollover kindly pay a visit to our web site. They often have partnerships with respected dealers and might supply a variety of gold merchandise, including bullion coins, bars, and rounds that meet IRS requirements.

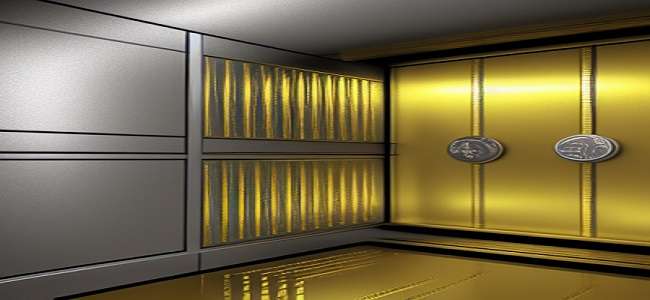

- Storage Options: Gold IRA companies typically present secure storage options for the bodily metals. The IRS requires that these assets be saved in a professional depository to ensure compliance and safeguard the investment. Firms often have relationships with secure vaults that offer insurance and safety against theft or injury.

- Compliance and Reporting: Gold IRA companies guarantee that every one transactions comply with IRS laws, which is crucial for maintaining the tax-advantaged standing of the IRA. They also handle essential reporting to the IRS, which incorporates offering annual statements and documentation relating to the value of the property held.

Advantages of Investing in a Gold IRA

Investing in a Gold IRA offers a number of benefits that can enhance an individual’s retirement strategy:

- Inflation Hedge: Historically, gold has served as a hedge in opposition to inflation. Because the buying energy of fiat currencies declines, gold usually retains its worth, making it a gorgeous choice for preserving wealth over the long term.

- Diversification: Together with gold in a retirement portfolio can cut back total threat. Gold typically behaves differently than stocks and bonds, providing a counterbalance throughout market downturns. This diversification can lead to extra stable returns over time.

- Protection Against Economic Uncertainty: Economic instability, geopolitical tensions, and financial crises can result in market fluctuations. Gold is commonly considered as a "safe haven" asset during such times, making it a strategic addition to a retirement portfolio.

- Tax Advantages: Like conventional IRAs, Gold IRAs offer tax advantages. Contributions could also be tax-deductible, and the funding can develop tax-deferred until withdrawals are made during retirement, potentially minimizing the tax burden.

Concerns When Selecting a Gold IRA Company

While the advantages of Gold IRAs are compelling, buyers must exercise due diligence when deciding on a Gold IRA company. Key considerations include:

- Repute and Expertise: Research the company’s track report, buyer critiques, and industry expertise. A reputable firm should have a historical past of glad purchasers and clear operations.

- Charges and Fees: Perceive the payment construction related to the Gold IRA. This may occasionally embody account setup charges, storage fees, transaction fees, and annual upkeep charges. Comparing charges across totally different reliable companies for gold-backed ira rollover can assist buyers make knowledgeable choices.

- Product Selection: Evaluate the vary of gold products offered by the company. Be certain that they provide IRS-approved metals and quite a lot of choices to go well with particular person funding preferences.

- Customer support: Sturdy buyer support is important for navigating the complexities of Gold IRAs. Select a company that provides accessible and educated representatives to assist with inquiries and facilitate transactions.

- Storage Options: Examine the storage solutions offered by the company. Be sure that they associate with reputable depositories that offer safe, insured storage for valuable metals.

Regulatory Concerns

Traders should bear in mind of the regulatory atmosphere surrounding Gold IRAs. The inner Revenue Service (IRS) has particular guidelines relating to the varieties of precious metals that can be included in a Gold IRA, as well as storage requirements. Non-compliance can result in penalties and tax liabilities, underscoring the importance of working with a knowledgeable Gold IRA company.

Conclusion

Gold IRA leading companies for retirement ira play a necessary role in serving to investors navigate the complexities of incorporating precious metals into their retirement portfolios. By providing expertise in account setup, compliance, and asset administration, these companies present worthwhile providers that can enhance financial safety in retirement. As economic uncertainties proceed to problem conventional funding strategies, Gold IRAs stand out as a viable option for diversifying portfolios and safeguarding wealth. As with all investment, individuals should conduct thorough analysis and consider their monetary objectives before committing to a Gold IRA. In doing so, they can take proactive steps toward constructing a resilient retirement strategy that withstands the check of time.